Changing retirement landscape in Britain

Delegates at the BlackRock Retirement Conference in London this month heard how Britons were saving more now into pensions than ever before.

Yet despite this positive message, there still remains a lot to be done in terms of education about contribution levels, understanding portfolio construction and ensuring a beneficial level of diversification during the accumulation stage, to help provide the best possible pension pot when it comes to decumulation.

Add to this the need to help people understand how to make this pension pot last for the whole of their retirement, not just for the first 10 or so years, and the picture becomes far more mixed.

Learning from the US and Australia

Retirement saving in the US and Australia has been examined by policy makers and pensions think-tanks for many years.

The idea is that the UK can learn from both nations as to how we can create a pension solution that works for both savers and spenders in the run-up to, and the years beyond, retirement.

Claire Felgate, head of UK defined contribution investments for BlackRock; Anne Ackerley, head of US and Canada defined contribution for BlackRock; and Justin Arter, head of institutional client business for UK, Middle East and Africa at BlackRock, took part in a panel discussion on how retirement saving is structured in the US and Australia, and what the UK can learn from this.

US situation

In the US, the workplace pension system is voluntary, and employers do not have to provide a plan. Employees are not compelled to save into it.

That said, Ms Ackerley said the majority of pension savings in the US are from employers, with a rising number of defined contribution (DC) schemes being used.

Most investors do not have the experience to invest over a 40-year journey

Moreover, she said where employers do offer automatic enrolment, there is more than 90 per cent participation.

Within these workplace schemes, many US employers are choosing target date funds as their default pension scheme option, especially as they meet certain criteria set by the US government in the Pensions Protection Act.

When it comes to investment, Ms Ackerley said: "People want 'do it for me'. Most investors do not have the experience to invest over a 40-year journey; they are happy to have a 'do it for me'."

However, she said the US needs to focus on the access - with 40 per cent of workers in the US unable to access a workplace pension scheme, particularly those who work for small employers.

If the US allowed multi-employer plans, she said this would go a long way to helping reduce the cost and administrative burden for US employers.

Secondly, she said the US needed to focus on the decumulation strategies, as the country was seeing a trend of Baby Boomers retiring.

This means, therefore, that money taken from 401k pension plans is now exceeding what is being put into pension pots by the Millennials.

"There's a notion of embedding an annuity into the 401k plan, in particular, into a target date fund", Ms Ackerley said.

"We don't have an annuity culture in the US ... there is a view it could be very helpful for at least a portion of people or for a portion of their savings, which is a contrast with the UK, which is moving away from annuities."

Australian situation

In Australia, the situation is different to the US and perhaps more similar to the UK.

Nearly 30 years ago, Australia brought in compulsion, which Mr Arter said took a "complex political process" to bring in a form of auto-enrolment and the escalation phase.

He told delegates: "Super, as it is known in Australia, is now embedded as part of a person's thinking.

"Yet there is still, surprisingly, a lack of engagement among younger people and a higher engagement among older people."

Worryingly, despite compulsory contributions going up to more than 9 per cent, government's means-tested state benefits are still the principal source of income for 70 per cent of retirees over 45.

"These structures take a very long time until they get up to a point where they are self-sustainable in terms of people paying their own way", Mr Arter said.

Moreover, he said the pots may not be enough to last well into retirement, with the vast majority of people retiring with a significant mortgage they have to pay off.

After they have paid off their debt, they try to manage their pension quite carefully, he said, but people may not have the appropriate tools to manage their investments.

Mr Arter added it was troubling that while the accumulation stage was good in Australia, the post-retirement / decumulation phase was "not well set up for that", with the annuities on offer being "opaque", and "poor value".

Culturally, he said, people do not like annuities or understand them.

As a result of the Murray Review in Australia, there are now debates going on as to whether there should be some form of compulsory scheme in retirement which can provide a regular income without the risk of the individual spending too much.

This could mean Australia is to bring in a new product being implemented, called MyAnnuity or My Pension.

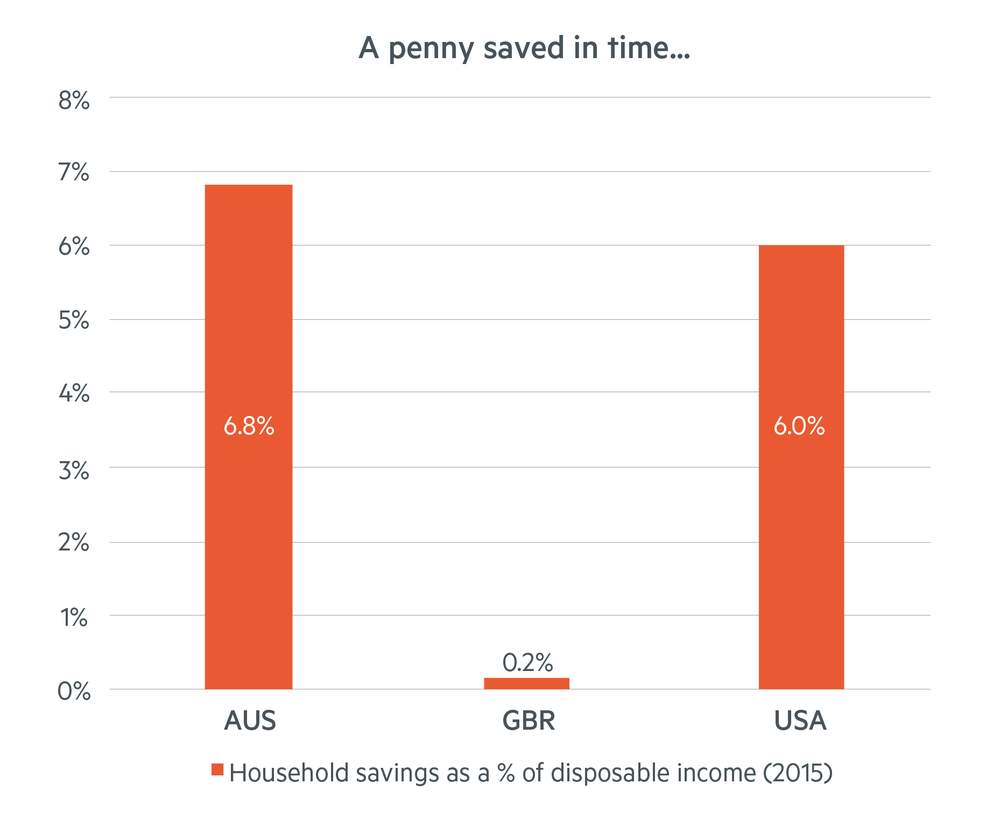

Ms Felgate showed a slide showing household saving as a percentage of disposable in the US, UK and Australia; the UK is at just 0.2 per cent. "This is a stark number" she said.

UK lags its US and Australian counterparts in terms of household savings

She added it was equally concerning that more than 24 per cent of this was in cash - similar to portfolios of Australian savers.

Too many people have savings sitting in cash

Given interest rates and inflation, she said cash and deposit accounts were not a low risk choice for long-term savers.

The panel agreed more needed to be done to encourage individuals to put extra in and invest wisely to ensure a positive outcome in their retirement.

Aspirations v reality: what your clients need to know about pension saving

More Britons are saving into a pension, but will this suffice for a comfortable retirement?

More people in the UK have started to save for retirement but there needs to be better education if they are to achieve a sizeable pension pot.

These were among the findings of BlackRock’s latest Investor Pulse and DC Pulse surveys, which aimed to assess levels of engagement, understanding and saving among adults in the UK.

Presenting the results at BlackRock’s Retirement Conference in London, Ali Bernat, head of EMEA retirement marketing for the fund manager, told delegates people needed to do more to fund a comfortable retirement.

He said: “Historically, a lot of people would have relied on state benefits and their defined benefit scheme to sort them out, but things are shifting. There are not as many certainties as there were.”

All this, coupled with rising longevity, means Britons need to start putting money aside as early as possible to help fund their retirement. A big part of this pension provision, Mr Bernat said, is the workplace pension scheme.

According to Mr Bernat, it is “fantastic” that more people are saving into some form of pension scheme, especially since auto-enrolment came into force in 2012.

The question is how can we put more pressure on people to increase their contributions?

But while he praised the effect of auto-enrolment for helping to get a further 8.3 million Britons saving into a workplace pension, he also warned there was a “huge danger” people were overestimating their contributions into pensions.

“Overall, people are not putting that much in”, he said, drawing delegates’ attention to data from the Office for National Statistics (ONS) on weighted-average contribution rates to private sector occupational pension schemes.

The ONS’s 2015 Occupational Pension Schemes Survey revealed the average employee member contribution in defined contribution (DC) schemes was 1.5 per cent, with 2.5 per cent on average from employers.

This compares unfavourably with career average schemes and defined benefit (DB) schemes, where the employee contribution is 5.5 per cent and 5 per cent respectively.

Ideally, people should be paying higher contributions. As a rule of thumb, the Department for Work & Pensions has said 15 per cent is a minimum recommendation, although contribution rates will depend on circumstances such as age, income level, expected provisions and the replacement rate.

Mr Bernat added: “We know people are not putting that much in, so the question is how can we put more pressure on people to increase their contributions?

“We need to find a way to tailor this message to different people, as their circumstances will be very different”, Mr Bernat concluded.